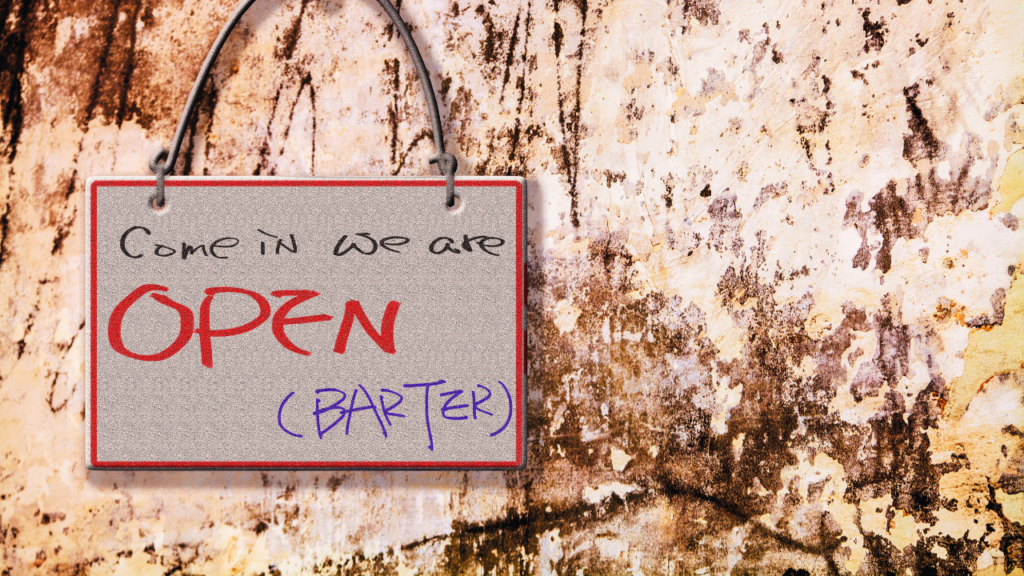

Think about how economic systems evolve. First comes barter – I have wheat, you have shoes, and we trade, but only if we both happen to want what the other has at the exact same moment. Economists call this the “double coincidence of wants,” and it’s brutally limiting. Barter economies can’t scale. They can’t support specialization or complex commerce. They’re stuck.

Then comes cash. A standardized medium of exchange means I can sell my wheat to anyone, hold the money, and buy shoes next week from someone else entirely. Cash doesn’t solve everything – it can’t be stored indefinitely, it doesn’t earn interest, you can’t borrow against future earnings – but it’s a massive leap forward. Transactions become flexible. Markets become possible.

Then comes banking. Suddenly you can save surplus value for later. You can lend to others and earn a return. You can borrow against future income. You can pool resources with strangers through intermediaries. Time itself becomes a dimension of economic activity. The complexity this enables – mortgages, insurance, investment, credit – is the foundation of modern prosperity.

Here’s the thing: until very recently electricity has been stuck somewhere between barter and cash for over a century. And in some ways, it’s closer to barter than we’d like to admit.

Yes, we have a standardized “currency” – a kilowatt-hour is a kilowatt-hour, tradeable on wholesale markets with real-time pricing. That’s the cash part. But electricity can’t be held, even briefly. It must be consumed the instant it’s produced. Generation and consumption must match in real-time, every second of every day, or the whole system fails.

That’s the barter part. The grid requires what you might call a “double coincidence of supply and demand.” At least with cash, you can stick a twenty in your pocket and spend it tomorrow. Electricity can’t wait even a second. In that sense, our sophisticated modern grid – for all its engineering marvels – operates on a more primitive economic logic than the coins in your pocket.

Power plants act like mills that must grind flour the instant wheat arrives, with no granary to hold reserves. Transmission lines function as couriers who must deliver goods immediately upon receipt – no warehouse, no inventory, no buffer. Grid operators run an impossibly complex logistics operation where the entire money supply must be spent the moment it’s created.

This isn’t an exaggeration. One (US) Congressional Research Service report described electricity as “essentially a just-in-time resource, produced as needed to meet the demand of electricity-consuming customers.” A recent analysis in Works in Progress put it more starkly: every other critical infrastructure system – water, hospitals, finance – depends on buffers, inventories, and reserves. The electrical grid is the lone exception, “a unique market with no inventories at all.”

The result is a system that maintains expensive reserve generation capacity sitting idle most of the time, like a society that needs enormous grain stockpiles just to handle harvest season – except the grain spoils instantly if not eaten. On a hot August afternoon when everyone cranks their air conditioning, utilities fire up inefficient “peaker” plants that might only run a few hundred hours a year. When renewable generation exceeds demand on a sunny Sunday afternoon, we curtail wind turbines and waste clean energy because there’s nowhere for it to go. It’s the economic equivalent of farmers dumping milk because no one happens to be thirsty right now.

For over a century, we’ve engineered around this limitation rather than solving it. We’ve built an astonishingly complex real-time balancing system, a continent-spanning coordination mechanism that matches supply to demand second by second. It’s a genuine marvel. But it’s a marvel built on a primitive economic foundation – one that’s increasingly showing its age.

Battery storage changes everything. It’s not just a new technology bolted onto the old system. It’s the emergence of banking in what has been an economy stuck between barter and cash. For the first time, electricity can be saved. Value can be stored. Time becomes a dimension of the energy economy.

And once you have storage – once you have the electrical equivalent of a savings account – the rest of the banking infrastructure starts to follow.